Jet, mansions figure in $232 million foreign trust case to be heard in Auckland court

6:05 AM Wednesday Jan 18, 2017

EXCLUSIVE: Auckland court to become scene of battle to prevent US seizure of assets, writes Matt Nippert.

An Auckland courtroom will on Friday become a battleground over Manhattan penthouses and a private jet amid allegations that they are the proceeds of a globe-spanning mega-fraud.

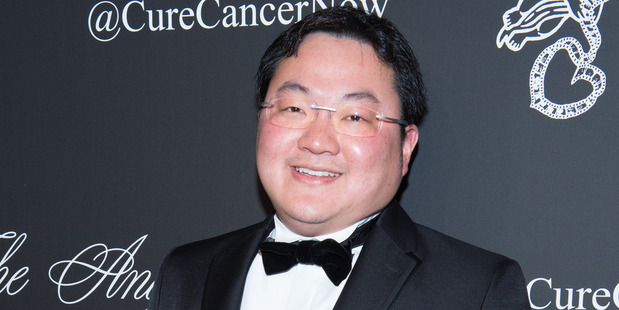

The High Court at Auckland is set down to hear a request from relatives of controversial Malaysian financier Jho Low who oppose the seizure of assets worth $230 million alleged by the United States Department of Justice to be the proceeds of crime.

US court filings said the relatives are beneficiaries of a number of New Zealand trusts that are claimed to directly own a number assets caught up the probe of a Malaysian sovereign wealth fund known as 1MDB.

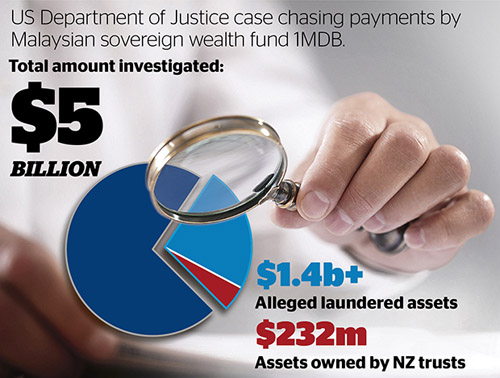

US Attorney General Loretta Lynch said in July when the DoJ first filed its seizure claims that $5 billion had been misappropriated from the Malaysian state with payments by 1MDB diverted into private Swiss bank accounts and then laundered into artwork, Hollywood films and real estate.

"We are seeking to forfeit and recover funds that were intended to grow the Malaysian economy and support the Malaysian people. Instead, they were stolen, laundered through American financial institutions and used to enrich a few officials and their associates," she said.

Financier Low is one of three individuals named in the DoJ action as receiving the proceeds of the alleged fraud. The others are a Hollywood producer and step-son of Malaysia's current Prime Minister, and a former government official from the United Arab Emirates.

Before his legal troubles Low had a reputation as an international playboy, having been photographed partying with the likes of Paris Hilton and Leonardo DiCaprio and sailing the world on a superyacht named Equanimity.

Equanimity, a 91m long vessel worth $200m, last visited Auckland in February 2016.

Low and the other pair named in proceedings have denied wrongdoing. The DoJ action is civil in nature, but international media reports say criminal probes into the affair are ongoing in both the United States and Switzerland.

The New Zealand connection only came to light several weeks ago when relatives of Low complained in US courts that trustees were not challenging the seizure orders.

Filings from their lawyers said they wished to ask the New Zealand High Court to appoint someone who was willing take on the DoJ.

The US filings say some current trustees were concerned that failing to oppose their replacement raised the possibility they might fall foul of US laws criminalising money-laundering.

The High Court at Auckland confirmed a defended hearing involving the parties was set down for Friday morning.

The filings claim a number of New Zealand trusts, with names as varied as Elephant Sun and Stars Tower, were the direct owners of assets including a Bombardier private jet, a hotel in Beverly Hills and a $55m Los Angeles mansion formerly owned by Fantasy Island actor Ricardo Montalban.

New York real estate owned by the New Zealand trusts includes two Manhattan apartments, including a $43m penthouse in the Time Warner Centre formerly owned by celebrity couple Beyonce and Jay-Z.

The DoJ have claimed these assets are collectively worth more than $230m.

According to Companies Office filings, the New Zealand trusts in question were established and directed by staff of Auckland law firm Cone Marshall, and also used the local trust specialists' Stanley Street office as a mailing address.

Cone Marshall principal Geoffrey Cone declined to comment on the case outside of noting his firm acted on behalf of a Swiss-based trust group and that he had no direct contact with beneficiaries.

"This is a matter concerning the Rothschild Group and Rothschild Trust New Zealand for which we provide local director and office services," he said.

Barrister Pravir Tesiram, acting for Rothschild, said he had nothing to say about Friday's hearing or the wider 1MDB case. "I can't comment on that. And, as a matter of practice, we don't comment on client matters anyway," he said.

Questions sent to Rothschild's in Zurich were also met with "no comment". "This is because we are unable to comment on ongoing legal proceedings," a spokeswoman said.

Relatives of the Low family could not be reached for comment.

The 1MDB scandal has generated headlines worldwide since breaking over the past year.

Other assets caught up in the DoJ action, but not owned by New Zealand trusts, and alleged to have been funded or purchased with fraud include a $1b Manhattan hotel, a large slice of record label EMI's back catalogue, Monet and Van Gogh paintings, and rights to the film Wolf of Wall Street.

The Wolf of Wall Street, starred Leonardo DiCaprio in a based on the true story of a white-collar criminal. A DoJ official said at the time the complaint was laid that the subject material was deeply ironic: "This is a case where life imitated art."

Case rekindles trusts debate

The appearance of New Zealand trusts in the 1MDB affair threatens to re-ignite controversy over our foreign trust industry.

The release last April of the Panama Papers, a large-scale leak of previously secret company and trust data maintained by Panamanian law firm Mossack Fonseca, had thrust New Zealand's role in the international finance scene into the spotlight.

A subsequent government inquiry, headed by John Shewan, had proposed tighter regulation and more transparency for the foreign trust industry but concluded there was "no direct evidence of illicit funds being hidden in New Zealand foreign trusts".

The Labour and Green parties both said the 1MDB developments - disclosing control of $230m in alleged proceeds of crime by foreign trusts which will this week be contested in an Auckland courtroom - meant Shewan's conclusions should be revised.

Labour leader Andrew Little said the appearance of New Zealand in the 1MDB affair risked our international reputation and showed Shewan's conclusions were "naive".

"We've got to be moving swiftly on this," he said.

Green Party co-leader James Shaw said: "This demonstrates National's .... resistance to regulate so New Zealand's squeaky-clean corruption-free brand can be protected," he said.

Revenue Minister Judith Collins in a statement stood by the Shewan report. "The Inquiry also considered it reasonable to conclude that there are cases where foreign trusts are being [abused] ... Taking this into account, the Inquiry made recommendations to substantially increase the disclosure rules."

She said the government adopted all recommendations made by Shewan and the resulting Bill was currently before Parliament and expected to pass its third reading in March.

No comments:

Post a Comment